How to Save Up For a House: Planning to Purchase Your Future Home

Purchasing a home is a significant milestone in many people’s lives, but the prospect of saving for a down payment can be daunting. However, with careful planning and disciplined saving habits, you can turn this dream into a reality.

In this comprehensive guide, we will explore effective strategies to help you save for a house down payment. By following these steps on how to save up for a house, you’ll be well on your way to owning your dream home.

How to Save For a Down Payment: How Much Do You Need to Save?

Before you embark on your savings journey, it’s crucial to determine how much you need to save for a down payment. This will depend on several factors, including the purchase price of the home, the mortgage loan’s terms, and the down payment percentage required by lenders.

It’s generally recommended to aim for a down payment of 20% of the home’s purchase price to avoid private mortgage insurance (PMI).

However, depending on your circumstances, you may be able to secure a mortgage with a lower down payment. It’s essential to evaluate your financial situation, consult with lenders, and understand your options.

By calculating your target down payment amount accurately, you can establish a clear savings goal.

How Long Should You Plan to Save?

Once you have a clear understanding of the amount you need to save, it’s time to establish a timeline. Saving for a house is a long-term goal, and it’s important to set realistic expectations when learning how to save money for a down payment.

Assess your current financial situation, including your income, expenses, and debt obligations. Analyzing your monthly cash flow will give you an idea of how much you can save each month.

Here is a table that breaks down how much you can save based on the amount you save and time you have:

| Savings Amount per Month | Years to Save | Total Savings Amount |

| $25 | 5 | $1,500 |

| $100 | 5 | $6,000 |

| $250 | 5 | $15,000 |

| $500 | 5 | $30,000 |

| $750 | 5 | $45,000 |

| $1,000 | 5 | $60,000 |

| $25 | 10 | $3,000 |

| $100 | 10 | $12,000 |

| $250 | 10 | $30,000 |

| $500 | 10 | $60,000 |

| $750 | 10 | $90,000 |

| $1,000 | 10 | $120,000 |

Consider the desired timeline for homeownership and how it aligns with your financial goals. Understanding the relationship between time and savings will help you set achievable milestones and track your progress.

Additionally, keep in mind that the longer you save, the more time you have to take advantage of potential market appreciation and interest on your savings.

8 Ways How to Save Up For a House

Here are eight of the most popular ways to start stacking more change for that big down payment:

1. Create a Budget

Implementing a budget is the foundation of effective savings. Start by tracking your income and expenses to get a clear picture of your financial situation. Categorize your expenses and identify areas where you can reduce spending.

Look for opportunities to trim unnecessary costs such as dining out, entertainment subscriptions, or impulse purchases.

By having a comprehensive overview of your finances, you can make informed decisions on where to allocate funds towards your down payment savings. Use tools like Mint or Rocket Money to help you track all of your personal spending and savings.

2. Reduce Unnecessary Expenses

While it might seem obvious, you probably need to spend less if you want to save more. In addition to creating a budget, it’s important to scrutinize your expenses and identify areas where you can make significant cuts.

Evaluate your monthly bills and look for alternatives to reduce costs. Consider negotiating lower interest rates on credit cards or refinancing high-interest loans. Explore options for lowering utility bills by adopting energy-saving habits or switching to more efficient appliances.

Every dollar you save on unnecessary expenses can be directed towards your down payment fund.

3. Increase Your Income

For some of us, we can’t sacrifice the things we love and if that’s the case for you, you’re going to have to find a way to make more money if you want to buy a house. Boosting your income is a powerful way to accelerate your savings progress.

Explore opportunities to increase your earnings, such as taking on a side hustle or freelancing.

Consider leveraging your skills or hobbies to generate additional income. Additionally, you can explore the possibility of negotiating a raise or promotion at your current job. Alternatively, investing in your education or acquiring new certifications can open doors to higher-paying opportunities in your field.

4. Automate Your Savings

When working on how to save up for a house, setting up automated savings is an effective way to ensure consistent contributions to your down payment fund.

Open a separate savings account dedicated solely to your down payment savings. Speak with your bank or financial institution to establish automatic transfers from your checking account to your savings account.

This “set it and forget it” approach eliminates the temptation to spend the money and ensures that a portion of your income is consistently directed towards your down payment goal. By automating your savings, you’ll make saving a habit without the need for constant manual transfers.

5. Cut Housing Costs

Housing expenses typically account for a significant portion of one’s monthly budget. Consider ways to reduce your housing costs to free up more money for your down payment savings. One option is to downsize your current living situation.

Assess whether you can comfortably live in a smaller space or explore affordable housing alternatives.

Additionally, consider finding a roommate to share rent and utility costs. Splitting expenses can significantly reduce the financial burden and accelerate your savings progress.

6. Save Windfalls

Take advantage of unexpected windfalls and channel them directly into your down payment fund. This can include tax refunds, work bonuses, or monetary gifts from family and friends.

Instead of treating windfalls as disposable income, view them as an opportunity to make substantial contributions to your savings.

By resisting the urge to splurge and redirecting these unexpected funds towards your down payment, you’ll make significant strides towards achieving your homeownership goal.

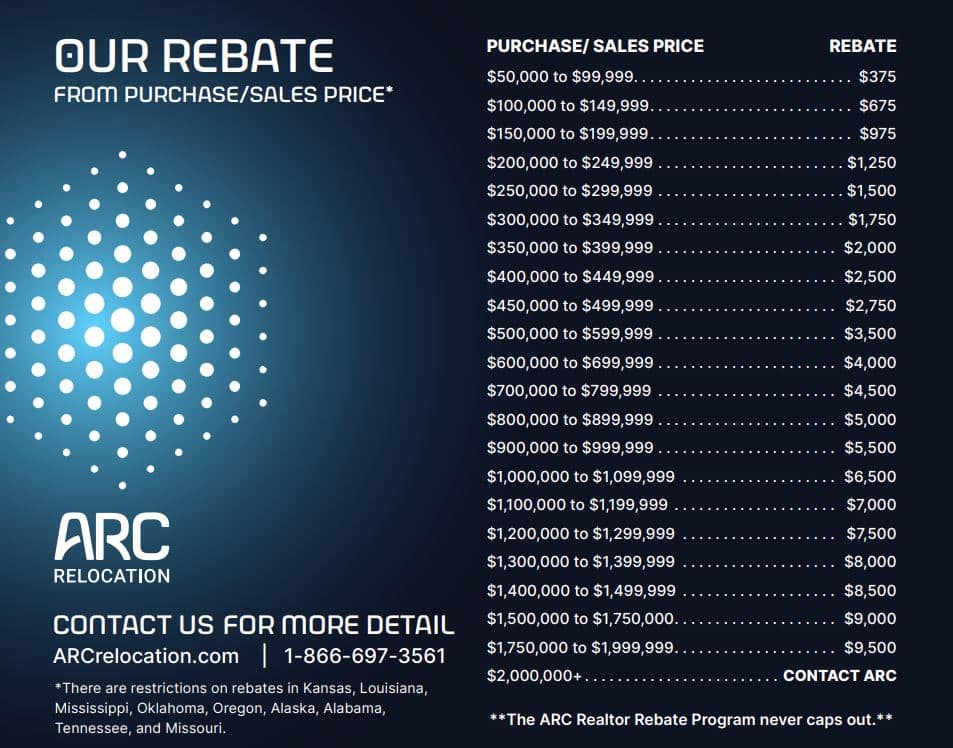

7. Get a Realtor Rebate

When purchasing a home, consider leveraging a realtor rebate program to save money on your real estate purchase.

A realtor rebate is a cash incentive provided by a real estate agent or brokerage to buyers at closing. This rebate is typically a percentage of the agent’s commission and can be a substantial amount.

By working with a realtor who offers a rebate program, you can receive a portion of the commission as a cash-back rebate, which can be directed towards your down payment.

At ARC Relocation, we offer a realtor rebate that beats the competition. Our rebates are higher, we have a large realtor network, and we’ll match any rebate you find! Click here to register today!

8. Explore Down Payment Assistance Programs

When working on how to get a down payment for a house, there are many local, state, and federal programs that provide down payment assistance to eligible homebuyers. These programs offer grants, loans, or tax credits to help individuals and families overcome the hurdle of saving for a home.

Research available down payment assistance programs in your area and determine whether you meet the requirements. The application process may involve income verification, attending homebuyer education courses, or meeting specific criteria. By leveraging these programs, you can significantly reduce the amount you need to save on your own.

How to Save For a Down Payment On a House: FAQs

How long will it take to save for a down payment?

The timeline for saving for a down payment can vary significantly depending on factors like your income, savings rate, target down payment amount, and more. Generally, it takes most people 3-5 years to save enough for a 20% down payment. The more you can dedicate to savings each month, the faster you’ll reach your goal.

What percentage down payment do I need?

While 20% is recommended to avoid paying for private mortgage insurance (PMI), you can get a mortgage with as little as 3% down. However, the lower your down payment, the more fees and higher interest rates you’ll typically pay over the life of the loan.

Are there any programs to help with my down payment?

Yes! There are various down payment assistance programs and relocation loans available at the state, local, and national level that provide grants, forgivable loans, or tax credits to eligible homebuyers. Your income, credit, and other personal factors determine qualification. Reach out to your state and local housing authority to learn about opportunities for down payment help in your area.

Should I save for a down payment or pay down debts first?

It’s generally wise to pay down high-interest debts before dedicating all extra funds to a down payment savings account. This helps improve your credit score and debt-to-income ratio so you can qualify for better mortgage rates. Once high-interest debts are paid off, focus on saving aggressively for your down payment goal.

Final Thoughts

Learning how to save up for a house requires discipline, patience, and commitment. It may seem like a daunting task, but with the right strategies and a clear plan, you can achieve your goal. Remember that saving for a down payment is a long-term endeavor, and it’s essential to stay focused and motivated along the way.

Start by calculating your target down payment amount and establishing a realistic timeline based on your financial situation.

Implement the strategies mentioned in this guide, such as creating a budget, reducing unnecessary expenses, increasing your income, automating savings, cutting housing costs, saving windfalls, exploring realtor rebate programs, and researching down payment assistance programs.

If you want to save the maximum amount of money on your home purchase, register now for the ARC Realtor Rebate program!