Guaranteed

Home Buyout Option (GBO)

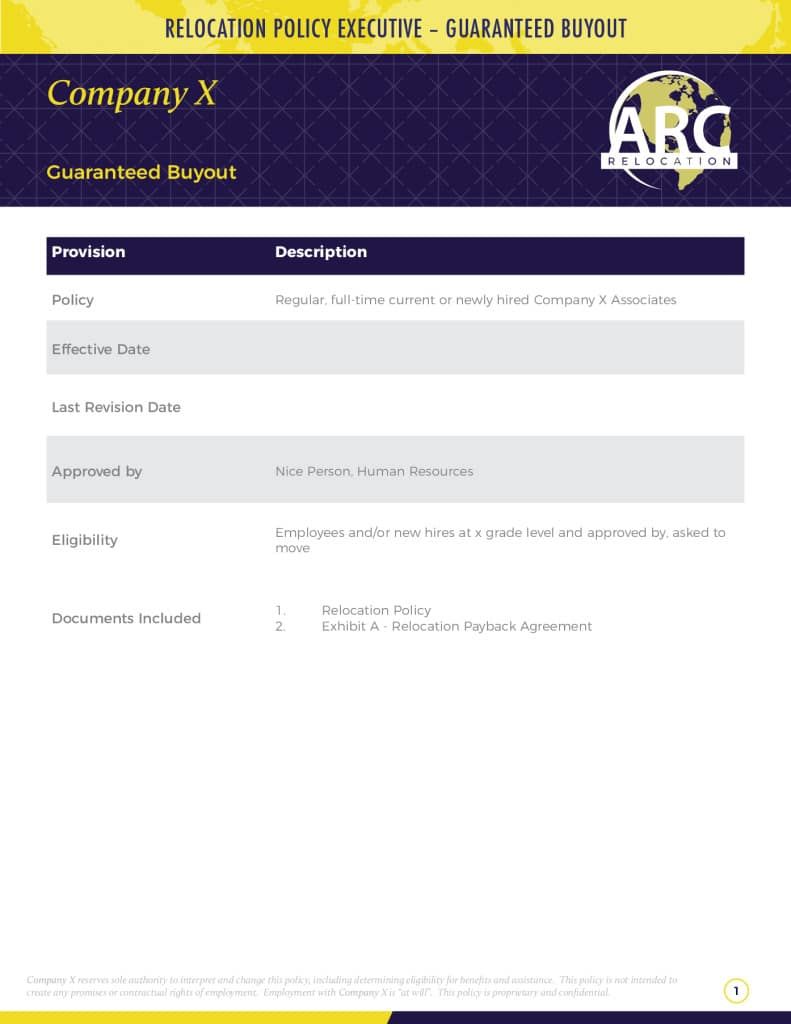

ARC Relocation Guaranteed Home Buyout Option

ARC offers our clients competitive advantages over other relocation companies when providing Guaranteed Home Buyout services. That’s why we’re one of the leading relocation companies around.

However, let’s first answer the questions: “what is a home buyout program”, “how does it work” and “why do clients offer a guaranteed home buyout to their relocating employees?”

The Guaranteed Buyout Program Explained in 1 Minute

How does a Guaranteed Buyout Option work?

The process is approved by the client company in the company relocation policy. Most commonly the relocation company purchases the home directly from the employee at “fair market value.” Fair market value is normally determined by outside appraisals. Last the home is generally inspected for defects.

Once due diligence has been completed the relocation company purchases the home from the employee.

The reloction company holds the home in “inventory” until the home sells to an outside buyer, allowing the employee to relocate to the new location without having to wait for an outside offer on the open market.

Do relocation companies buy houses?

Yes. That is one of the most utilized/needed services for some employees to relocate in a timely fashion.

Commonly known in the relocation industry as a “guaranteed home sale” or a “guaranteed home buyout” the relocation company purchases the home directly from the relocating employee to allow the employee to continue the relocation proceeds without having to wait for an offer on the open market from an outside buyer.

What are the advantage of using a Guaranteed Buyout Option?

There are three main advantages that company recorgnize when providing a Guaranteed Buyout Offer to employees that are relocating:

-

The Guaranteed Offer expedites the process and allows the employee to relocate to their new destination without having to wait to procure an offer from the open market.

-

A Guaranteed Buyout provides tax protection for both the employee and employer in regard to the realtor commissions and selling / closing costs.

-

It reduces stress by streaming the “escrow process” by dealing with a “professional buyer” vs the a buyer and agent from the general public.

The Advantages of Using ARC Relocation for a Guaranteed Buyout Program

- ARC’s independence and lack of franchise affiliations allow ARC to list homes with the best real estate brokerages to sell more quickly and for top do

- We take the title to the home and truly become the owner.

- ARC is considered an industry leader for guaranteed home buyouts (based on certifications and experience)

- We offer clients the best in software and technology to track the process.

ARC uses its expertise to advise clients on best practices while following all of the IRS and ERC guidelines for relocation home sale programs. Click here to learn more about IRS regulations. Also, we are a guaranteed home buyout vendor for the United States Government under GSA schedule 653-1. Being on schedule 653-1 means our process, technical capabilities and experience have all been screened and approved by the GSA. ARC provides guaranteed home buyout and home sale services for many of the agencies who regulate these services. In turn, our experience, technology and clientele, place us at the forefront of the industry.

Complete to Work with a Certified Relocation Counselor

Faq

The following FAQs were answered by ARC Relocation Consultant Andrew Sumner, with over a decade of experience in assisting companies and transferees execute guaranteed buyout offers.

These outline the industry best practices that both clients and transferees should consider and why.

Providing an employee with their guaranteed buyout offer should always be handled delicately by the relocation counselor, especially if the transferee’s home is priced significantly above their GBO. In real estate “over listing” a home is the largest mistake in home marketing. This often renders extended days on market and a lower ultimate sales price. A relocation counselor should know if the GBO will put the transferee in a deficit situation by asking about their mortgage balance during the initial call or seeing the balance noted on their title report. A deficit would require the transferee to send money to the relocation company prior to the acquisition of their home if they were to accept the GBO. This factor can make-or-break a phone call, so the presentation of the GBO to the transferee is vitally important.

Before delivering their GBO, I find it important to reiterate the purpose of a relocation appraisal. Most commonly the appraisers appoint a listing price for the home with an expectation to sell within a 120-day marketing period. It would be ideal for a transferee to sell their home on the open market to a buyer for a price higher than their GBO. However, in the event the transferee is unable to sell their home within 60 days (or 90 days, depending on the client), the GBO is their “fallback”. I also review what is done if an offer arrives that is greater than their GBO. (This ensures that the transferee is aware of all options to attract the highest offer on their home.)

The program’s ultimate objective is to allow the transferee to relocate whether or not an outside offer from the open market is received. The GBO price should be fair, and should reflect what the Relocation Company will ultimately resell the home for after carrying the home in their “inventory”. This is most successful when the client has established GBO requirements. If two Broker Market Analysis (BMA) are completed, many clients mandate that the list price does not exceed 105%. If these requirements exist, then a client can reduce the need to take a home into inventory.