Buying a home is one of the biggest investments most people make in their lifetime, and the mortgage that comes with it can be a massive financial burden. Don’t worry though, there are plenty of strategies you can use to save money on your mortgage and keep more cash in your pocket.

From shopping around for the best rates to making smart payment choices, we’ve got you covered with 11 effective tips on how to save money on a mortgage. Follow these strategies, and you could potentially save tens of thousands of dollars over the life of your loan.

1. Shop Around For a Loan

When it comes to mortgages, not all lenders are created equal. Interest rates, fees, and terms can vary widely, so it pays to do your homework. Get quotes from at least three different lenders – banks, credit unions, online lenders, and mortgage brokers – and compare the offers side by side.

Don’t just focus on the interest rate; look at the annual percentage rate (APR) which factors in fees, as well as closing costs, origination charges, and any other lender fees. Even a small difference in rates or fees can add up to major savings over 15, 20, or 30 years.

As you shop, be sure to get pre-approved, not just pre-qualified. Pre-approval means the lender has verified your credit, income, assets, etc. and actually approved you for a specific loan amount, giving you more bargaining power with sellers. Pre-qualification is just a basic eligibility check.

2. Increase Your Down Payment

The best thing you can do when figuring out how to save interest on a mortgage is to increase your down payment. The more you can put down upfront, the less you’ll have to borrow, and the more you’ll save in interest charges over time. Aim for a downpayment of at least 20% to avoid paying private mortgage insurance (PMI), which can add hundreds to your monthly payment.

If you can swing an even larger down payment, like 30% or more, you’ll save even more in the long run and may qualify for better interest rates too.

It’s wise to start saving early and make your down payment fund a priority. Cut any non-essential expenses, get a side gig, or look into down payment assistance programs that can help you reach that 20% threshold faster. The upfront investment will be well worth it in interest savings.

3. Negotiate

Don’t be afraid to negotiate with lenders. They want your business, and a little friendly haggling can go a long way. Come armed with the best quotes you’ve received elsewhere and ask them to beat the fees and rates. You can also request that certain costs, like loan origination fees, are waived entirely.

Be persistent yet respectful, and don’t be afraid to say “no” and walk away if a lender refuses to budge. There are plenty of options out there. Negotiating for a lower rate of just 0.25% can save you thousands upon thousands over a 30-year mortgage.

4. Wisely Utilize Your Home’s Equity

If you’ve built up substantial equity in your home, either through your down payment, mortgage payments over time, or rising property values, you may be able to tap into that equity to save money.

Refinancing to a lower interest rate, shortening the term of your existing loan, or taking out a home equity loan or home equity line of credit (HELOC) could make sense in some situations.

Just make sure you carefully calculate the costs of any new loan, including closing costs, fees, etc. And be realistic about whether you can comfortably afford any new payments. Home equity is a powerful tool for saving for a mortgage, but only if you utilize it wisely.

5. Make Bi-Weekly Payments

Instead of making a single monthly payment, consider making half-payments every two weeks. Over the course of a year, you’ll end up making the equivalent of 13 full monthly payments instead of just 12, which can shave years off your mortgage term and save you thousands in interest charges.

For example, on a $250,000 mortgage at 4.5% interest over 30 years, switching to bi-weekly payments would save you over $30,000 in interest and allow you to be mortgage-free almost 5 years sooner. Most lenders will gladly accommodate this payment schedule, but be sure to confirm there are no additional fees involved.

Another option is to simply set up automatic bi-weekly half-payments online through your bank’s bill pay service. This accomplishes the same goal in a more hands-off way.

6. Get a Realtor Rebate

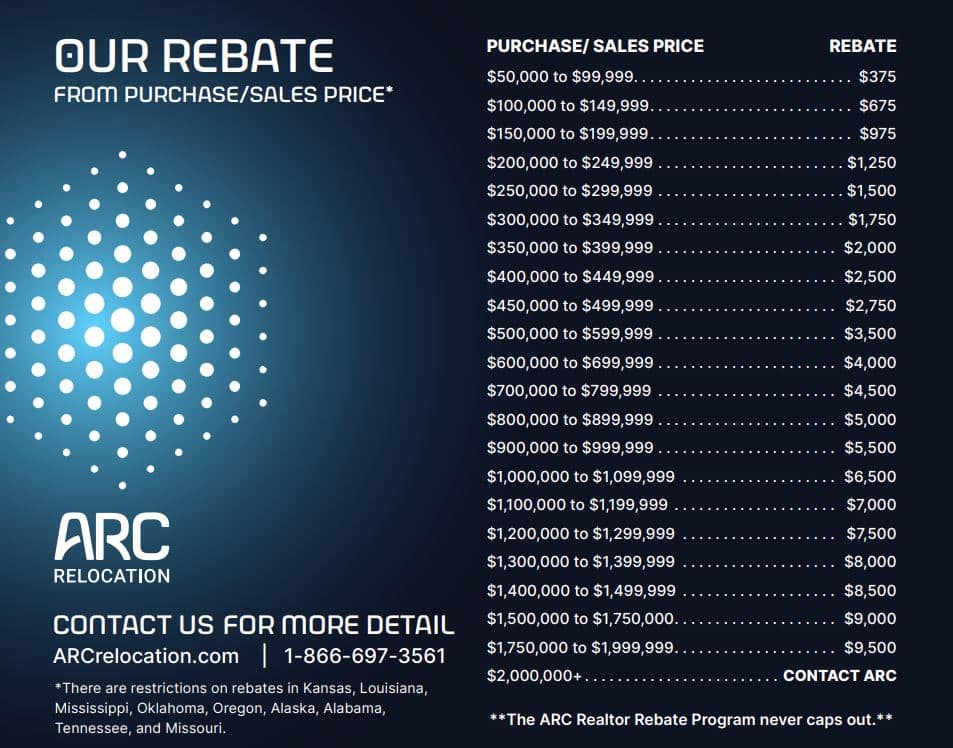

When you buy a home through ARC Relocation’s Realtor Rebate program, you can get a cash rebate of up to 1% of the purchase price after closing.

That means if you buy a $400,000 home, you could pocket up to $4,000 to put towards your mortgage principal, closing costs, or even new furniture and home improvements. It’s an easy, no-hassle way to save big money right from the start.

The rebate program is available in most states across the U.S. Simply register on ArcRelocation.com before your home search begins. ARC’s Partner Agents are top-rated in their local markets and will provide the same expert service as any other realtor. Earn cash back while getting a great agent – it’s a win-win!

7. Pay Down Principal Regularly

Even small extra payments applied directly to your mortgage principal each month can make a huge difference over time. If you can swing an extra $100 or $200 per month, you’ll shave years off your loan term and save a bundle in interest charges. Many lenders allow you to easily set up automatic extra principal payments online.

Or, you could follow a strategy like making one extra mortgage payment per year, whether that’s with your tax refund, a year-end bonus, or some other financial windfall. The key is to ensure those additional funds are applied to the principal only rather than being spread across the next several payments.

Over 30 years, paying just $100 extra per month could save you over $60,000 in interest on a $300,000 mortgage! It’s one of the most powerful tactics for accelerating your payoff and avoiding excessive interest.

8. Avoid Private Mortgage Insurance (PMI)

As mentioned earlier, if your down payment is less than 20%, you’ll likely have to pay private mortgage insurance premiums, which can add hundreds to your monthly costs. PMI premiums are designed to protect the lender in case of default, but they provide no benefit to you as the borrower.

Once you’ve built up 20% equity in your home through payments and/or appreciation, be sure to promptly ask your lender to remove the PMI – you shouldn’t have to keep paying those premiums anymore at that point. Setting a calendar reminder can help you stay on top of this potential money-saver.

9. Get an Energy Efficient Mortgage

Some lenders offer special “green” mortgages that factor in the cost savings of an energy-efficient home. You may be able to qualify for a larger loan amount based on the anticipated utility bill savings, making that pricier but more eco-friendly dream home a little more affordable.

Alternatively, you could receive a bigger tax credit for an energy efficient mortgage or property. These programs make a lot of sense given that the upfront costs of solar panels, HVAC upgrades, etc. will pay off through lower utility costs month after month. Be sure to ask your lender about energy-efficient mortgage options.

10. Improve Your Credit Score

If you want to know how to save on mortgage interest, improve your credit score. Raising your credit score, even by just a few points, could help you qualify for a much lower mortgage interest rate that saves you thousands over the life of the loan.

With good credit, lenders view you as less of a risk and reward you with their best terms and pricing.

When you have good credit, you won’t need to worry if you are ever in a situation where you need to sell your house fast for relocation. A good credit score will make the process much smoother when it comes to purchasing your new home.

Pay down credit card balances to less than 30% of your total credit limits. Remove any errors or derogatory items from your credit reports. Avoid opening new credit accounts before applying for a mortgage. And make all debt payments on time, every time – payment history is the biggest factor impacting your scores.

In general, a FICO score in the mid-700s or higher will get you the most attractive mortgage rates and terms. A score over 800 is considered excellent. Every 20-point increase in your score could translate to tens of thousands of dollars in savings.

11. Buy Within Your Means

Another way how you can save money on your mortgage is to buy within your means. While mortgage lenders will often qualify you for your absolute maximum borrowing potential based on your income, debts, and credit, don’t automatically take out the largest loan amount you can get approved for. That leaves you financially stretched razor thin with little margin for error.

Instead, consider getting a more modest mortgage on a less expensive home that you can truly afford comfortably. Lenders don’t factor in other monthly expenses like utilities, gas, groceries, etc. when calculating your mortgage eligibility. Those costs add up quickly on top of your new mortgage payment.

Stretching your housing budget to the absolute limit also leaves you “house poor” with little leftover income for retirement savings, college funds, travel, and other life priorities. You’ll likely struggle to stay current on all bills and maintenance, risking foreclosure.

It’s wise to build in ample breathing room by buying a home that costs less than the priciest one a lender approves you for. Look for a payment of no more than 25% of your take-home pay. Modest housing costs = financial peace of mind.

How to Save Money On a Mortgage: FAQs

How much should I put down on a house?

While the minimum downpayment is usually just 3-5% for FHA, VA and some conventional loans, experts recommend putting down 20% if possible.

A 20% downpayment gets you out of paying private mortgage insurance premiums and lowers your overall borrowing costs. If you can swing 25% or more, even better – the larger the downpayment the lower your long-term interest costs.

Is it worth refinancing my mortgage?

Refinancing can be beneficial if you can lower your interest rate by at least 0.75-1% and plan to stay in the home long enough to recoup the closing costs.

Those costs can run 2-5% of your loan balance, so calculate your break-even point carefully. Also consider if you want to change your loan term or type of mortgage. A refinance calculator can help you run the numbers.

Can I deduct mortgage interest on my taxes?

Yes, you can deduct the interest paid on up to $750,000 of qualifying mortgage debt (or $375,000 if married filing separately) if you itemize deductions on your tax return.

This can provide significant tax savings, especially in the early years of your mortgage when more of each payment goes toward interest rather than principal. Check with a tax pro, as rules do change periodically.

What is an escrow account and do I need one?

Most lenders require that you pay a portion of your property taxes and homeowners insurance premiums into an escrow account each month along with your mortgage payment.

The lender then pays those bills from the escrow funds when they come due. This prevents a large lump sum payment from being due each year. While not strictly required, escrow accounts help protect the lender’s collateral.

Do I need mortgage protection insurance?

Mortgage protection insurance, also called mortgage life or disability insurance, can cover your mortgage payments if you lose your job, become disabled, or pass away unexpectedly. These policies are optional but can provide valuable peace of mind for families, especially if money is tight or you’re the sole breadwinner.

Final Thoughts

Buying a home and financing a mortgage is a major financial commitment requiring diligent preparation. But being a savvy borrower can help you snag a better deal upfront and save tens of thousands of dollars over the long run.

From shopping lenders to making smarter payment choices, don’t overlook opportunities to shave years off your loan and keep substantial sums in your pocket.

If you want to know how to save money on a mortgage, following these 11 tips can help. Register for the ARC Realtor Rebate program to help you save thousands on the purchase of your home.